DigitalOcean - Even the Little Guys Need Cloud Computing Services

Beyonce uses DigitalOcean for her personal website. Need I say more?

Brief Overview

DigitalOcean’s mission is to simplify cloud computing for businesses and developers. By making cloud computing both simple and cost-efficient, companies can focus on growing their business and developers can focus on creating great software.

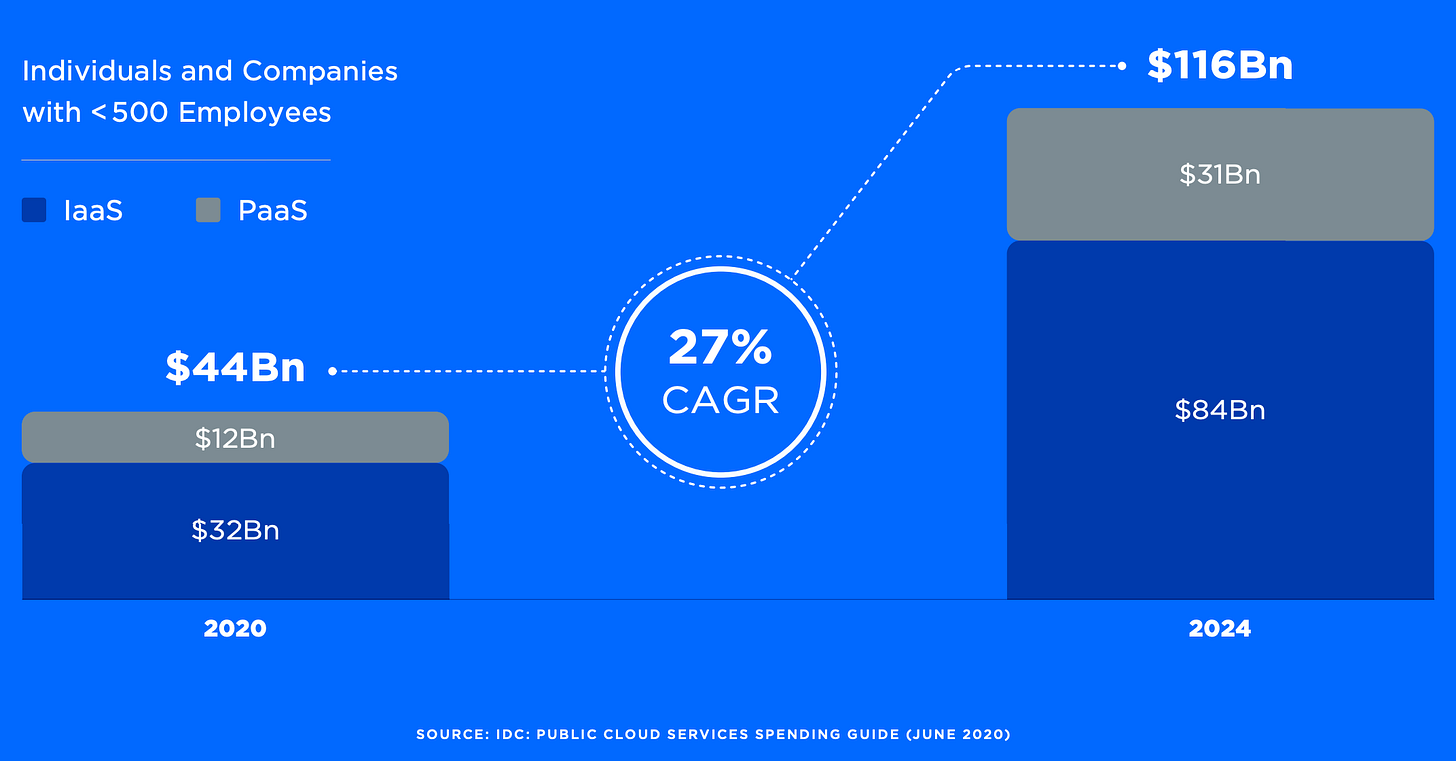

DigitalOcean generates revenue from customers’ usage of their cloud computing platform. DigitalOcean derives revenue from two cloud sources:

Infrastructure as a Service (IaaS) - provides essential compute, storage and networking services

Platform as a Service (PaaS) - developers can build, deploy and scale applications on the cloud

Basic Company Info

Name - DigitalOcean

Year Founded - 2012

Ticker Symbol - (NYSE: DOCN)

Website - https://www.digitalocean.com/

Headquarters - New York, New York

Number of employees - ~600

Sector - Technology

Industry - Software - Infrastructure

Market Cap (11/30/2021) - $10.7bn

IPO Date - 03/24/2021

What does Digital Ocean Do?

DigitalOcean’s mission is to:

…simplify cloud computing so developers and businesses can spend more time creating software that changes the world.

DigitalOcean aims to achieve this mission by providing on-demand infrastructure and platform tools for developers, start-ups and SMBs that are easy to leverage, broadly accessible, reliable and affordable. DigitalOcean primarily targets SMBs and segments large cloud providers like AWS, Azure and Google Cloud Platform overlook. Customers span many different industry verticals including web and mobile applications, website hosting, e-commerce, media and gaming, personal web projects etc. Many of the libraries and frameworks used at DigitalOcean are open source. DigitalOcean notably only supports Linux, an open-source opearting system. While it might seem odd to only support Linux and say not Windows, cloud computing was essentially invented on Linux. Rackspace, an IaaS provider, has a great article on this topic:

Linux is a natural technology for enabling cloud computing because: it's modular, power efficient, reliable, open source, scales to support critical workloads and is ubiquitous…it runs 90% of the public cloud workload…All the major public cloud providers Amazon Web Services (AWS) to Microsoft Azure and Google Cloud Platform (GCP) use different versions of Linux.

The company started out purely as an IaaS platform. IaaS is considered the original ‘as a service’ offering. Every major cloud provider began by offering some form of IaaS. When DigitalOcean was launched in 2012, in keeping with the ocean theme, the first product lauched was called Droplet. A droplet is scalable, virtual machine. A virtual machine, at its core, is simply a virtual computer within computer. It has dedicated amounts of CPU, memory, and storage that are "borrowed" from a physical host computer. The below graphic provides an overview of this concept:

As the company grew, they added more IaaS services such as Dedicated Droplets, Spaces, Managed Kubernetes, and Managed Databases. Each of these services are a natural extension of Droplets - as companies were realizing the benefits of using the cloud for their compute/storage/networking needs, they did not want the complexity of self-managing their databases or kubernetes. In late 2020 DigitalOcean rolled out DigitalOcean App Platform, a PaaS offering that allows developers to quickly build and deploy apps without needing to customize the underlying infrastructure. Below is an overview of those company’s service offerings have evolved:

All of this cloud hosting currently sits on 14 total data centers: New York, Amersterdam and San Francisco have three each, while Singapore, London, Frankfurt, Toronto, and Bangalore have one each. Currently DigitalOcean has 598,000 customers spread across 185 countires. DigitalOcean briefly rose to fame when the company’s arguably most famous and earliest customer, Beyonce, launched her album in December 2013 online at Beyonce.com and it was revealed to be running on DigitalOcean.

The 3 Main Cloud Services - An Introduction

It important to understand the differences between the main cloud services in order to understand DigitalOcean’s business model and how the cloud market works.

There are three main cloud services - IaaS, PaaS and SaaS. They are not mutually exclusive and many (typically larger) companies choose to utilize all three cloud services. This article from IBM provides a great overview of the various cloud services. Below is a brief description of each service:

IaaS - refers to computing resources provided over the internet such as networking, storage and compute. Cloud providers are responsible for managing the physical data center infrastructure. Customers typically choose between virtual machines hosted on shared phyiscal hardware or bare metal servers that are hosted on dedicated physical hardware. In the IaaS model, businesses are responsible for the purchase, installation, configuration, and management of their cloud-hosted software—including operating systems, middleware, and applications. Typical business use cases include: hosting critical applications with high-traffic like an e-commerce website, utilizing CPU-intensive applications such as machine learning or batch processing and providing data storage and backup recovery. Virtual machines can also behave like an actual computer and run in a window as a separate computing environment; this is common for peoples’ work computers.

PaaS - encompases all the components in IaaS and the cloud provider also maintains all the software included in the platform like the development tools and operating system. The cloud provider manages all the backend services and system administration that is required in IaaS. PaaS is ideally suited for companies and developers that want to build, deploy and scale apps more quickly while offloading infrastructure management to the cloud provider

SaaS - describes the actual software applications that are hosted on the cloud and delivered on the internet. Websites or apps that are accessed on the internet such as Gmail, Netflix or Zoom are all examples of commonly used SaaS products

In short, SaaS includes PaaS and IaaS. PaaS includes IaaS. IaaS is the original ‘as-a-service’ model. Microsoft provides a great graphic and additional overview that helps to illustrate how these services are all related:

What Problem is DigitalOcean Solving?

DigitalOcean wants to tear down the barriers to entry for SMBs that might benefit from cloud infrastructure technologies. According to CEO Yancey Sprull, software developers, entrepreneurs and small and medium-sized businesses (SMBs) were poorly served by the emerging cloud computing providers. DigitalOcean’s S-1 breaks down the several, favorable trends that are benefiting the company:

Technology impacts how businesses of all sizes operate and ultimately drives competitive advantages. Nearly every company will want to harness technology through cloud services

Proliferation of cloud native start-ups and SMBs are being built in the cloud so they can manage business solutions more easily

Software developers are increasingly becoming more influential as businesses rely on developers to spot changes in technological trends in order to compete. DigitalOcean’s mission is to improve the developer experience and their productivity

Open source helps to lower costs, increased speed to market, application reliability and flexibility and improved security

Organizations are increasingly using multiple clouds and will want to avoid vendor lock-in to legacy IT infrastructure servces

DigitalOcean believes their key differentiators and competitive advantages can be distilled into four principles - simplicity, support, community and open source:

DigitalOcean provides simplicity by offering a simple UI (user interface), CLI (command line interface), API (application programming interface) and thorough documentation. Using a browser, simply choose the version of Linux, plan type, datacenter region, number of droplets and your virtual machine is up and running:

Great customer support is available 24/7. DigitalOcean invests heavily in the community of developers. The company provides thousands of tutorials and contains 30,000+ community generated questions & answers. DigitalOcean gives back to the community by sponsoring community projects and hosts the largest hackathon in the world, Hacktoberfest, which attracted 170,000 participants in 2020. Intel is notably a sponsor of Hacktoberfest. The open source software not only enables faster innovation, but it allows customers to write their own integrations while not being locked into a propietary stack. As a result of these efforts, DigitalOcean attracts 3.5 million visits a month. The below stats are well flaunted on the company’s website:

Digital Ocean is Swimming in a Large Body of Water

The market that DigitalOcean operates in is large and growing quickly. While a large TAM (Total Addressable Market) does not guarantee success, it is certainly eye opening to see that public cloud service spend on SMBs (<500 employees) is projected to grow at a 27% CAGR between 2020-2024 to reach $116 billion:

Keep in mind that DigitalOcean has customers in 185 countries, so their potential source of growth comes from the number of developers globaly, number of SMBs globally and expected net new increase in SMBs:

DigitalOcean Scores Favorably in Transparency, Affordability & Performance Metrics

In addition to the four key principles discussed above that help to separate DigitalOcean from its competitors, the company also importantly scores favorably on transparency, affordability and performance metrics.

DigitalOcean emphasizes that their pricing is both transparent and predictable. DigitalOcean’s pricing lets you see ahead of time how much you will end up paying. AWS employs a ‘pay-as-you-go’ model that requires the end-user to monitor usage. The company has a dedicated FAQ section on ‘Cost Management’ and there are many articles online providing tips on how to avoid suprise bills, such as this one from CloudHealth and this one from DZone. Corey Quinn, Chief Cloud Economist at The Duck Bill Group, whose mission is to “…help companies fix their AWS bill by making it smaller and less horrifying”, has garnered 75,000+ followers on Twitter poking fun at AWS such as this tweet below:

Looking at the cost of DigitalOcean’s Basic Droplet, a virtual machine that runs on a shared CPU, the cost of the comparable product on AWS and Azure is 60% more expensive:

Cloud Spectator, an independent benchmarking firm, found that DigitalOcean delivered the best CPU performance per dollar compared to AWS and google:

ScaleGrid, a company that provides Database-as-a-Service hosting solutions and helps companies manage their database opertions, performed an analysis comparing the cost of deploying MongoDB®, a popular NoSQL database, on AWS or Azure vs DigitalOcean. Scalegrid determined that ScaleGrid Dedicated Hosting service for MongoDB on DigitalOcean saves companies, on average, 122% and 140% on the monthly storage costs compared to AWS and Azure respectively:

Leadership

None of DigitalOcean’s co-founders consisting of Ben Uretsky, Moisey Uretsky and Mitch Wainer serve in any executive capacity, although Ben and Moisey collectively own just over ~16% the company. a16z, famed VC tech firm founded by Marc Andreessen and Ben Horowitz, were early investors in the company by participating in a Series A round in 2014 and own ~17.5% of the company. Peter Levine, general parter at a16z, joined the board as part of the Series A fundraising, and announced would continue staying on the board post IPO.

Notably there has been some turnover in leadership in the last few years. Ben Uretsky, was previously CEO at DigitalOcean until 2018. In early 2018, Uretsky announced his decision to step down for a couple of reasons including needing someone with more experience and the possibility of an IPO. The company selected Mark, Templeton, who worked at Citrix Systems from 1995-2015 and was CEO between 2001-2015. Templeton only stayed with DigitalOcean for a year before stepping down to due a personal health issue in May 2019. DigitalOcean announced in July 2019 that they appointed both a new CEO and CFO to “…position the company its next phase of growth” aka code for IPO preparation. Former SendGrid COO and CFO Yancey Spruill was named as its new CEO and former EnerNOC CFO Bill Sorenson as its new CFO. Both of these folks have experience in IPOs and sales.

Prior to DigitalOcean, Spruill was COO and CFO of SendGrid, an email delivery company, that was acquired by Twilio for $3 billion in an all-stock deal in early 2019. Spruill was CFO at DigitalGlobe between 2004-2014, a satelite imaging company, for 10 years. He also has extensive investment banking experience earlier in his career. Spruill received a B.S. in Electrical Engineering from the Georgia Institute of Technology and an M.B.A. from Dartmouth College.

CFO Bill Sorenson was previously CFO at Enernoc, an intelligent energy company, which got sold to investor Enel Group between 2016-2017. Sorenson was CFO at Qlik Technologies, a business intelligence firm, between 2008-2013 and led the company to eventual IPO. Mr. Sorenson received a B.A. in Foreign Languages from LeMoyne College and an M.A. in International Relations from American University.

Competition

While DigitalOcean’s offerings have expanded, their product portfolio is not nearly as extensive as AWS, Azure or Google Cloud Platform. DigitalOcean lists these companies as larger competitors in the S-1 filing, but since DigitalOcean and the large cloud providers are targeting different markets, DigitalOcean does not necessarily need to offer such a breadth of products to be competitive. Additionally, the large cloud providers have significantly more hosting capacity. DigitalOcean’s server capacity is probably about 1% that of AWS. As noted above, DigitalOcean still scores favorably on price-performance despite having a much smaller data center footprint.

DigitalOcean’s notes in the S-1 filing that smaller cloud service providers such OVH, Vultr, Heroku and Linode are competitors. OVH, founded in 1999, is a French cloud computing company with large global footprint. OVH currently has 32 data centers spanning four continents. OVHcloud, the company’s public cloud service, scores much less favorably on popular review websites such as Trustpilot and g2.com. TechRadar’s review of OVHcloud specifically suggests that users consider DigitalOcean or Linode.

g2.com’s ‘Best Infrastructure as a Service (IaaS) Providers’ ranks Linode number 1 out of 137 for highest satification while DigitalOcean ranks 5th. Linode seems to be one DigitalOcean’s most direct competitors by size, mission and service offerings. Linode, founded in 2003, has 800,000 customers compared to DigitalOcean at 598,000, and has data centers in 11 regions compared to 8 at DigitalOcean:

Similar to DigitalOcean, Linode deploys Linux virtual machines with simple pricing and no suprise bills. Linode has a dedicated page comparing it to DigitalOcean and notes a few advantages as follows:

Independence - Linode is private and does not have any financial liabilities, so customers do not have to worry about Linode answering to shareholders

Stability - Linode is run by the original CEO of 18 years

Advanced services - Linode offers advanced services DDoS proection while DigitalOcean requires customers to purchase separately through a provider like Cloudflare.

Interestingly, Linode admits that DigitalOcean has features not currently offered by Linode, such as Managed Databases and build-in CDM with Object Storage. Linode portrays DigitalOcean being public as a negative, but being public also gives DigitalOcean certain advantages over Linode such as free publicity, credibility and money to invest. DigitalOcean also has a PaaS offering while Linode does not offer this platform.

Heroku is a PaaS platform that was founded in 2007 acquired by Salesforce for $212 million in 2010. Given that DigitalOcean only recently entered the PaaS market, Heroku is naturally more recognized and established. One review comparing the two options indicated that DigitalOcean’s pricing was favorable, but felt that “…the general developer experience could be improved”.

Operational Highlights & Financial Results

DigitalOcean reported their most results for recent quarter, Q3 2021:

Revenue grew 37% YoY to hit $111 million

ARR, or annual recurring revenue, increased 36% YoY reaching $455 million.

ARPU, average revenue per customer, was up 28% YoY

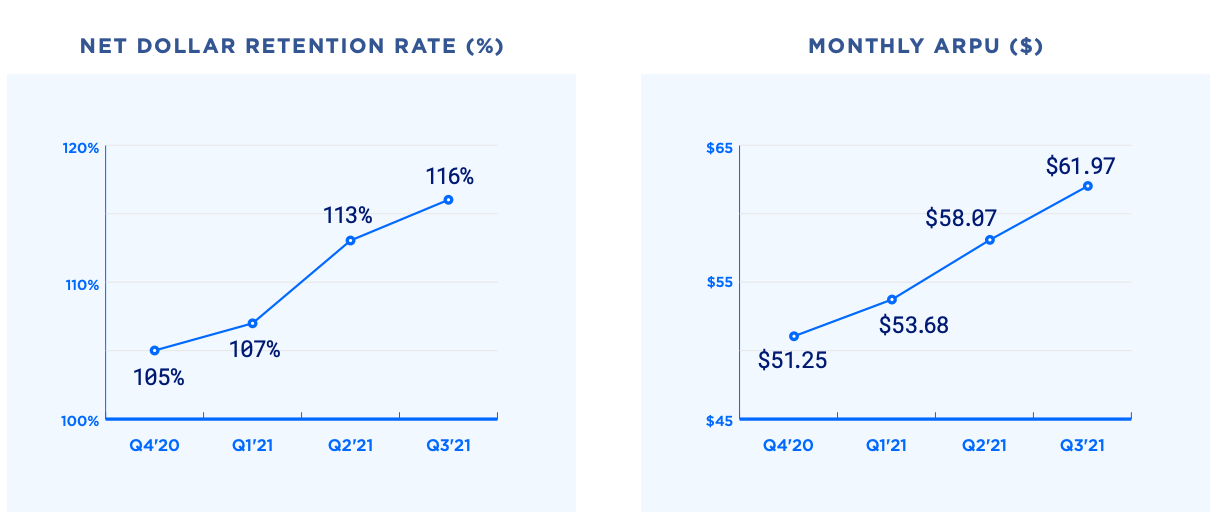

Net Dollar Retention was up 1200 basis points reaching 116%.

DigitalOcean’s growth has been accelerating recently. DigitalOcean might possibly be hitting an inflection point where they are entering a period of sustained, accelerating growth. YoY revenue growth rates accelerated in the past four quarters, and YoY ARR growth rates have accelerated in the previous three quarters:

Some of this growth can partly be attributed to improving customer economics. NDR and monthly ARPU are trending in the right direction:

Improving customer economics is only possible if DigitalOcean is able to attract high quality customers. Fortunately we got a clue in the conference call about customer quality, when CEO Spruill noted that 15% of the total customer base accounts for roughly 85% of total revenue. This quote from Spruill talks how this segment performs markedly better than the company as a whole:

These customers have a higher net expansion rate, as many of them buy multiple products, and churn at a much lower rate, in the mid-single digits versus low double digits for the entire Company. Importantly, the number of larger customers are growing several times faster than our overall customer growth rate. We expect these trends to continue where these larger customers grow faster, have a higher NDR, and therefore will represent a larger share of our total revenue mix over time.

The company now derives 10% of revenues outside the infrastructure platform. Spruill stated that they are track to achieve 20% of total revenues outside of infrastructure when DigitalOcean hits $1 billion in annual revenues by 2024. PaaS generates higher gross margins so this should benefit the company long term.

From a profitability standpoint, CEO Spruill touts that:

Our profitability is an attractive differentiator for a company whose growth rate continues to accelerate.

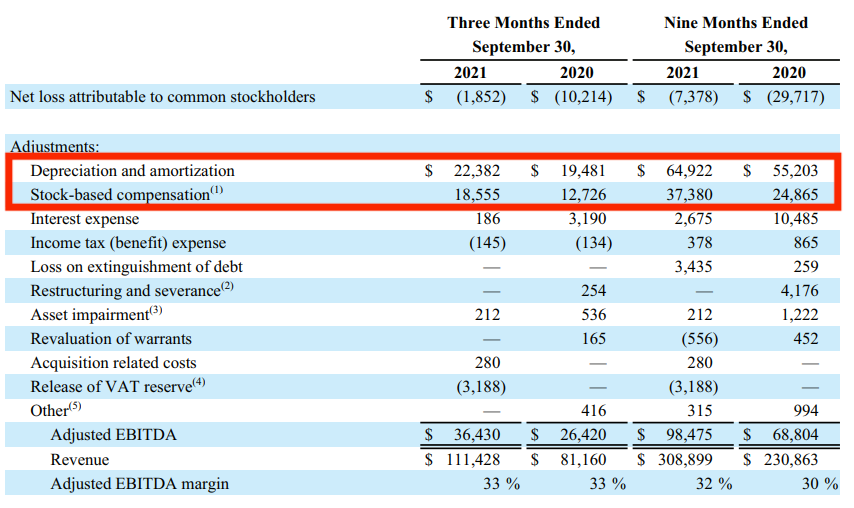

The company is not profitable on a GAAP basis with slightly negative net income of ($1.85 million) on $111.4 million revenue in Q3 2021. CEO Spruill’s comment about “….profitability being an attractive differentiator” is in reference to adjusted EBITDA, which subtracts certain (largely non-cash) expenses. D&A and stock-based comp account for essentially the entirety of the adjustment:

Fortunately capex as a % of revenue has been trending downwards and was at 25% in the most recent quarter. This is a capex intensive business so this number probably will not go much lower in the near future.

A few other notable items from the recent quarter includes:

Hiring of a new Chief Product Officer, Gabe Monroy, who previously worked at Azure. Monroy started his own company, sold it to Azure and stayed with Microsoft leading a large team

DigitalOcean will have invested $100 million in 2021 on their global infrastructure footprint

CFO and CEO both mentioned several times they believe that a 30%+ revenue growth rate is durable and sustainable

Acquires Nimbella, a serverless platform provider. DigitalOcean’s press release about this that gives more detail on it. Serverless and PaaS have some simlarities - one of the differences is that serverless allows applications to scale automatically up and down depending on demand

Guidance for the quarter and year-end represents expected YoY revenue growth rates of 34%-35%:

Conclusion

Companies should maximize time spent on building their businesses, and not worrying about having the right tools to turn their ideas into the great application or website. DigitalOcean is targeting entrepreneurs and SMBs who want simplicity, efficiency, and cost-effective pricing structure. DigitalOcean’s emphasis on providing simplicity, efficiency, and cost-effective pricing structure seems to be resonating with customers as evidenced by the accelerated grow rates in revenue, ARPU, ARR and NDR in recent quarters.

DigitalOcean’s non-infrastructure revenue accounting for 10% of total revenues shows that the company is able to be relevant outside of IaaS. The Nimbella acquistion, although very early, will be interesting to watch as the company pushes further away from core competencies. DigitalOcean purchased Nanobox, a PaaS platform, in 2019 before rolling out DigitalOcean App Platform in 2020. Given that the acquistion only took place in September, the company will likely take some time integrating Nimbella before launching an official product. While terms were not disclosed, both Nanobox and Nimbella appear to be very small companies (Nimbella has 5 employees on LinkedIn) so these acquistions seem like an inexpensive way to gain talent and expertise.

There are definitely some concerns; notably the changes in leadership in the last few years. CEO and CFO seem to have a good handle on the business but I prefer to invest in founder-led companies. However, the company has the backing of a16z, one of the most famous VCs, and their continued presence on the board indicates they were obviously onboard with the management changes. This is a capex intensive industry, so that capex as a % revenue number can easily creep back up if the company feels it is facing more competition.

It is impress impressive that DigitalOcean will more than double revenue and more than triple adjused EBITDA between 2018 and 2021:

At today’s market cap of $8.9 billion, DigitalOcean currently trades for ~21x FY 2021 estimated revenues and ~69x FY 2021 estimated adjusted EBITDA. Since management reiterated sustaining 30% or better revenue growth in 2022, this means the company should hit at least $555 million next year, implying a valuation of ~16x FY 2022 estimated revenues.

DigitalOcean will very likely never achieve the scale or level revenues generated by the major cloud providers, but they do not need to in order for investors to get a good return. It looks like the company can sustain 30%+ growth based on recent quarterly results, commentary from management and new product launches from recent acquistions. Management is targeting $1 billion in revenue by 2024, which works out to be roughly a 32% CAGR between 2021-2024.

DigitalOcean makes sense for investors looking to get exposure to the growth in cloud computing, but are wary of purchasin companies trading for high multiples of revenue like Cloudflare, Datadog or Zscaler. If DigitalOcean is at an inflection point for accelerating growth then the stock should do well.