Prosus: The Story of a (Unfortunately) Complicated European Tech Company - Part 1

Want to own a complex holding company with stakes in mulitple, emerging tech companies?

2 Part Series

Given the complexity of analyzing Prosus this will be a two part series. The first part dives into the complicated shareholder structure/relationship with parent company Naspers and why the company trades for a discount relative to its NAV. The second part will dive into the actual business model and management of Prosus.

Basic Company Info

Name - Prosus

Year Founded - 2019

Ticker Symbol

Primary listing: Euronext Amsterdam (AEX:PRX)

Secondary listing: Johannesburg Stock Exchange (XJSE:PRX)

Website - https://www.prosus.com/

Headquarters - Amsterdam, Netherlands

Number of employees - 23,939

Sector - Communication Services

Industry - Internet Content & Information

Market Cap (1/25/2026) - $112bn

IPO Date - 9/11/2019

Investment Summary

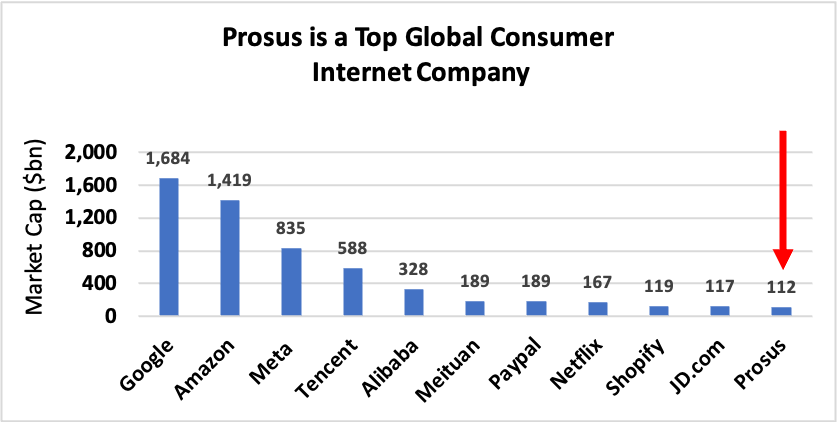

Prosus, translated as “forward” in Latin, is Europe’s second largest consumer internet company behind the German software corporation SAP

Prosus invests in young tech companies with an emphasis on emerging markets. It’s largest asset is a massive 28.9% stake in Tencent worth around $167bn today

Prosus has “hidden” value. It was spun off in 2019 from Naspers, a South African conglomerate, because Naspers consistently traded at a discount to its net asset value. Naspers currently retains majority control of Prosus.

Similar to parent company Naspers, Prosus faces a valuation discount but now in Amsterdam. For context, Prosus’ stake in Tencent is worth more than the entire NAV prosus and thereby values the rest of the business at zero

Investing in Prosus is a bet on a) management’s continued ability to help early-stage technology companies scale and grow and b) Prosus’ discount to net asset value narrows over time

Prosus Overview

Prosus is a global consumer internet company. It is one of the largest global consumer internet companies in the world:

Prosus invests in technology companies around the world with stakes in public and private companies. Prosus primarily invests in young tech companies with an emphasis on emerging markets. The company’s largest and most successful investment is a large stake in Tencent, purchased in 2001 for $32 million, that is now worth $167bn despite Prosus trimming its stake in Tencent twice. Additionally, Prosus company has several investments in various e-commerce verticals. The company has developed a specific expertise in online classifieds, payments, and food delivery sectors while also growing out an edtech and ventures portfolio. Prosus has a primary listing on Euronext Amsterdam (AEX:PRX) and secondary listings on JSE Limited’s stock exchange (XJSE:PRX) and A2X Markets (PRX.AJ) in Johannesburg, South Africa.

Prosus was spun-off in late 2019 from Naspers, a large South African media conglomerate that trades on the Johannesburg Stock Exchange. Naspers decided to spin off its interests outside of South Africa into this new company because Naspers stock price constantly traded at a discount to its Net Asset Value (NAV). Notably, Naspers wanted to maintain control of Prosus’ assets and states that Prosus is a subsidiary of Naspers. As a result, Naspers only floated 26.2% of Prosus’ shares on the day of the IPO. Additionally, the Naspers management team was also put in charge of the newly created company. Since the 2019 IPO, Naspers has increased the amount of available free float twice. Naspers first increased the free float in early 2020 from 26.2% to 27.5%. Naspers then raised the free float again in 2021 after it launched a voluntary share exchange by swapping existing Nasper shares for newly issued Prosus shares. This resulted in Prosus free float (shareholders external to Naspers) shareholders being entitled to a 58.9% effective economic interest in the company and Naspers holds the remaining 41.1%.

The second restucturing was much more significant than the first one. Prior to this second restructuring, Naspers had a majority stake in Prosus while Prosus owned a very small stake in Naspers. As majority shareholders, Naspers elected to increase the available free float of Prosus by allowing Prosus to substantially increasing its onwnership in Naspers from only a few percent to 49%. This was done to help alleviate the discount that both Naspers and Prosus traded at releative to their Net Asset Value (more on this issue later). While the two companies were always closely aligned, the cross-holding structure now becomes much more significant:

Naspers Retains Control of Prosus

While Prosus free float shareholders are now entitled to a majority effective economic interest in Prosus, the cross-holding agreement allowed Naspers to keep majority voting control. As part of the substantial increase in free float, Naspers implemented a capital restructuring for Prosus. The capital restructuring allowed for the issuance of a new class of B shares that are not listed and held only by Naspers.

While Prosus free float shareholders now have a 58.9% effective economic interest in Prosus, Naspers continues to retains majority owernship and voting control of Prosus. The new structure is as follows:

With majority voting control, Naspers can naturally do whatever it wants. Case in point, Prosus amended its articles of association to allow for the company to issue a new share class, A2 shares, that have 1,000 times the voting rights of the existing A1 and N shares. Similar to the newly issued B shares, A1 shares are not listed and held only be Naspers. If Naspers’ voting control ever falls below 50%, then the A1 shares will automatically convert to A2 shares and carry 1,000 votes per share.

Prosus Trades for an Absurd Discount to NAV

Does Naspers’ control of Prosus sound complicated and unnecessary? You bet. The market agrees. Prosus management values the company by performing a sum-of-the-parts valuation (SOTP) analysis. According to the most recent results for 1H FY22 ending September 30, 2021, the company’s NAV is $219bn or €133 per share:

Naturally one would assume that the stock price would trade close to the NAV per share. However, this is not the case. Using the most recent NAV provided by management and comparing it to today’s market cap, Prosus trades at a 49% discount to NAV with a current market cap around $112bn compared to a NAV of $219bn:

In other words, you can buy Prosus for $0.51 on the dollar. Not a bad deal as long as you do not mind purchasing shares in a byzantine corporate structure. In addition to increasing the free float, Prosus management has also bought back shares to try and lower the discount to NAV. Prosus most recently announced an intent to repurchase $5bn worth shares in phases between August 2021 and August 2022. This was not the first buyback performed by management. In November 2020, Naspers announced a $5bn buyback program that was completed in June 2021, consisting of a $3.6bn buyback of Nasper shares and a $1.4bn buyback of Prosus shares:

Why Such a Massive Discount?

Prosus trading at such a massive discount to NAV is an indication that the market believes that Prosus is a risky company that is unlikely to enhance shareholder value. Buybacks and increasing the free float is simply not doing the job.

The market assigning a conglomerate discount to Prosus is not too surprising. Generally investors prefer to invest in single-segment companies and do not trust conglomerates to manage a hodgepodge of different business types. However, the conglomerate discount here is far greater for a few reasons:

Tencent stake is worth $167bn today. As of the most recent recent NAV calculation where the Tecent stake was valued at $164bn, this equated to 75% of total NAV. Prosus is a holding company that buys stakes in technology assets but it does not control in its largest asset, Tencent.

There is substantial reinvestment risk that Prosus will leverage its large stake in Tencent and reinvestment the money unwisely. Prosus has twice lowered its stake 33% ownership stake in Tencent, first in 2018 raising $9.8bn and then again in 2021 raising $14.7bn, lowering its overall stake to 28.9%. Will management reinvest these proceeds wisely?

Prosus is valued as an extension of Naspers. If Naspers traded at a discount for so many years, and Naspers decided to reproduce a similar shareholder structure for Prosus, should the valuation gap really disappear entirely?

Prosus acts like a venture capital company. Venture capital companies typically use high discount rates to value their investments and Prosus is no exception. Glancing at their portfolio it certainly looks like a VC:

Naspers Trades for an Even More Absurd Discount to NAV…a “Double Discount”

According to the most recent results for 1H FY22 ending September 30, 2021, the company’s NAV is $92bnbn or ZAR6 402 (Zar = South African Rand) per share:

Doing some basic math illustrates that Naspers currently trades at a 62% discount to NAV:

Investors certainly may want to buy Naspers for $0.38 on the dollar rather than buying Prosus for $0.51 on the dollar. Naspers has essentially created a “double discount” by splitting the international assets into Prosus. Prosus trades at a discount to Tencent and Naspers trades at a discount to Prosus.

Naspers Had a Valuation Problem for a Long Time

Naspers has had a dual-class share structure before listing a portion of the international assets under the new entity, Prosus, in Amersterdam. In fact, Naspers itself consistently traded at a discount its net asset value (NAV) for years. According to Naspers management, prior to IPO, a listing on the Euronext Amsterdam would be beneficial for the following reasons:

Expand the investor base. CEO Bob van Dijk told reporters on IPO day: “The idea with today’s listing is emphatically that we find a new generation of investors here, on the Euronext, for our further growth.”

Outgrowing the Johannesburg stock exchange. At one point Naspers accounted for 25% of the stock market’s entire value. Institutional investors were forced to sell shares to limit their risk. The local currency, the South African Rand, also happens to be very volatile especially compared to the Euro.

Lower the discount to NAV. Listing on a larger, global stock exchange, like the Euronext Amsterdam, should allow the market to value Prosus’ assets properly. Naspers outgrew its home exchange because of its incredibly successful investment in Tencent…a problem that management probably did not envision when they invested in Tencent back in 2001. Tencent is a leading Chinese internet company with dominant positions in social media and gaming. Naspers paid $32 million for a stake in Tencent in 2001 that is now worth around $167bn despite trimming its stake twice in the company. Because Tencent skews the overall investment results of the investment portfolio of Prosus, in a good way, that during Prosus Capital Markets day in December 2019, management highlighted that Tencent single handedly nearly doubled the entire IRR generated on all internet investments:

Naspers Also Has a Complicated Share Structure

Naspers cannot blame their stock price’s discounted valuation solely on outgrowing the Johannesburg stock exchange and searching for an expanded investor base. Similar to Prosus before the second capital restructuring, Naspers has two classes of shares, N shares and A shares. The N shares are listed and the A shares are unlisted. The A shares also have 1,000 votes per share.

Naspers CEO and General Counsel both appear in a nicely edited 6 1/2 minute video on Naspers investor relations page to explain the benefits of the dual-class share structure for both Naspers and Prosus. The reasons include:

Ensure that Naspers and Prosus remain an independent company. This is vital for Naspers’ investor partners in the countries that Naspers operates

Allows Naspers to ride out deep investment cycles to maximize shareholder value over time

General Counsel, David Tudor, explains how the voting class structure has been in shortly after Naspers went public in 1995. Tudor explains how the class structure is “straightforward”:

Two classes of shares, A and N. A shares are unlisted and each A share is entitled to 1,000 votes while N shares are listed

Keeromstraat (Keerom for short) and Nasbel hold the majority of the A shares. Keerom and Nasbel control more than 50% of the voting rights of Naspers.

The benefit of creating the two entities, Keerom and Nasbel, is to ensure the continued independence of Naspers for the benefit of both Naspers and its stakeholders. Both Keerom and Nasbel are required to act in a way that benefits Naspers stakeholders and protects the indepedence of Naspers

Keerom and Nasbel are the custodians of the independence of Naspers.

Keerom and Nasbel excercise their votes in consultation with each other. Keerom and Nasbel are required to vote against any resolutions that “materially” affect the independence of Naspers and its businesses

Keerom’s shareholders are mostly private investors

Nasbel is indirectly owned by Naspers with a 49% shareholding and the majority remaining shareholders are private investors

Most people would probably agree that the below chart certainly does not scream “straightforward”:

CEO Djik later explains how a dual-class share structure is common for tech companies like Facebook. An article written on Harvard Law School Forum on Corporate Governance however disagrees, and notes that:

Investors overwhelmingly favor the one-share, one-vote capital structure

Companies with dual-class share structures face more governance challenges

Dual-class share structures do not necessarily offer an edge on performance

Essentially investors are told that accepting this byzantine share structure is truly for the benefit of all the shareholders and that they should never question management. Pretty amazing how Keerom and Nasbel are required to vote against any resolutions that “materially” affect the independence of Naspers. While unfortunately complex, it is necessary to understand the share structure because as noted previously, Naspers has majority control of Prosus.

Up Next - Part 2

Now that you understand the the complicated relationship between Prosus and parent company Naspers, part 2 will go into more detail about the actual Prosus business model.