Searching for the Next, Younger Version of QQQ

Helping investors find ETFs that hold that hold the next generation of innovators

Overview

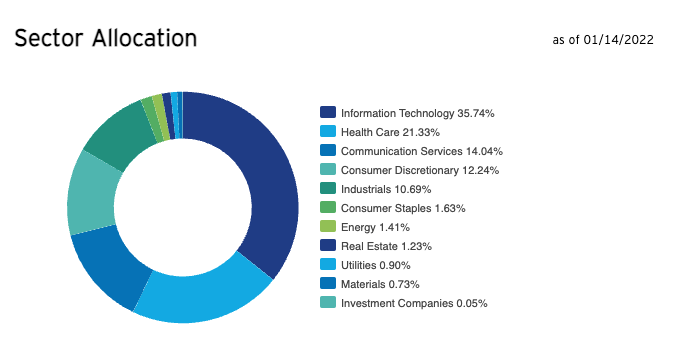

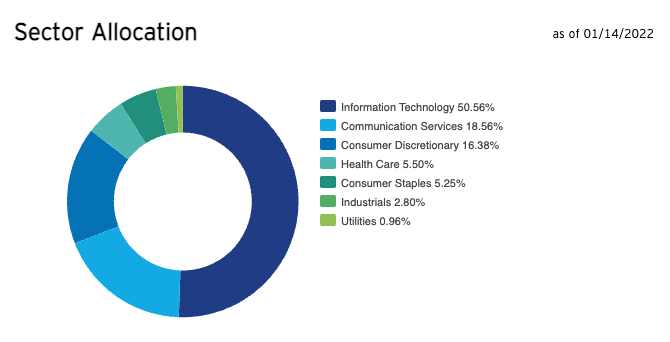

As many financial investors are aware, Invesco QQQ is one the most popular ETFs for investors that want exposure to large cap tech stocks. The ETF tracks the performance of the Nasdaq-100 Index. The Nasdaq-100 comprises the 100 largest domestic and international non-financial companies in the NASDAQ Composite Index based on market capitalization. Because the Nasdaq Composite is a capitalization-weighted index, The Nasdaq-100 Index accounts for more than 90% of the weight of the Nasdaq Composite Index. The Nasdaq-100 is heavily concentrated towards information technology with an over 50% weighting. Communication services and consumer discretionary account for 18.56% and 16.38% respectively:

The index includes some of the best performing and well-known companies in American innovation such as Apple, Google, Facebook, Microsoft, Tesla, Netflix etc. Using the popular ETF, Invesco QQQ Trust, as a investable benchmark for the performance of the Nasdaq-100 Index, QQQ has handily crushed the performance of the S&P 500 (using SPDR S&P 500® ETF as the benchmark) and the Russell 2000 (using iShares Russell 2000 ETF as the benchmark) over the last 10 years:

That is a substantial amount of alpha! The Nasdaq-100’s annualized 10 year return exceeded S&P 500’s by over 700 bps and the Russell 2000 by 1,000 bps. It should come as no surprise that the ETF, QQQ, is the fifth largest ETF as measured by AUM, while three of the top four all track the S&P 500. Fortunately, the S&P 500 has a 29.2% weighting in information technology, which contributed greatly to the performance of the overall index.

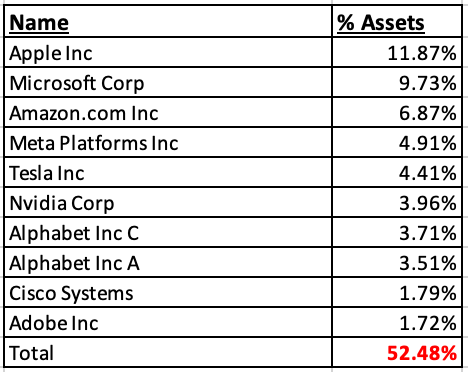

Using QQQ as a investable benchmark for the Nasdaq-100, the top 10 stocks account for 52.73% the total index:

Searching for the Next QQQ

The Nasdaq-100 has performed so well, relative to other indices, because the weightings were concentrated in both great companies and growth industries - especially technology. While QQQ will likely remain a strong long term performer, investors may want to consider investing in ETFs that contain stocks that are both disruptive but earlier in their growth curve. This is due to a few reasons:

The Law of Large Numbers

Large concentration in top holdings of QQQ

Over the long run small caps to tend to outperform large-cap stocks

The Law of Large Numbers, in a financial context, states that as companies grow in size, it becomes difficult to maintain the same percentage of growth. Essentially it is easier to double revenues when yearly revenue is $1 million but is it much harder to double revenues when your yearly revenue is $100 million. As such, long term investors are potentially incurring a significant opportunity cost by keeping all of their money invested in these large cap companies. Instead, long term investors may benefit by allocating a portion of their investable assets to companies in the earlier stages of growth.

As noted above, the Nasdaq-100 is very heavily weighted in the top 10 holdings. Investors may want to allocate money to other funds in order lower concentration risk. Lastly, small cap stocks tend to outperform large-cap stocks over the long run.

I am going to highlight a couple of different ETFs that will allow investors to gain exposure to smaller, faster growing companies that operate in disruptive industries similar to QQQ. The following ETFs will be discussed in more detail:

Invesco NASDAQ Next Gen 100 ETF - (NASDAQ: QQQJ)

WisdomTree Cloud Computing Fund - (NASDAQ: WCLD)

Global X Cloud Computing ETF - (NYSE: CLOU)

ARK Next Generation Internet ETF - (NYSE: ARKW)

Invesco NASDAQ Next Gen 100 ETF - QQQJ

In October 2020, Invesco launched a new ETF to capitalize on the success of their immensely popular ETF, QQQ. The Invesco NASDAQ Next Gen 100 ETF (NASDAQ: QQQJ) tracks mid-capitalization stocks, and will invest at least 90% of its total assets in the 101st to the 200th largest companies on the NASDAQ Composite Index. Similar to it’s older brother, the Nasdaq-100 index, the sector weightings lean heavily towards information technology, communication services and consumer discretionary. One notable difference is that health care is the second largest weighting with a 21% allocation:

Nasdaq Invesco’s head of Americas ETFs is quoted as saying:

QQQJ will give investors access to 100 mid-cap companies using technology to disrupt their sector. While this does include companies in the technology sector, the commonality across these companies is their legacy of using innovation and technology to create competitive advantages across multiple sectors and industries.

The top 10 holdings are much less concentrated than the Nasdaq 100 index:

The top 2 holdings, Old Dominion Freight and AstraZeneca, may not seem like next-gen companies, but both have managed to outperform the S&P 500 since going public. Old Dominion Freight has crushed the returns of major indices, returning 1,170% over the last 10 years compared to a 614% return in the Nasdaq-100 and 333.5% return for the S&P 500. The Trade Desk is a leader in programmatic advertising and is run by founder Jeff Green. Costar Group is a leading provider of real estate data to real estate professionals. Given the large sector weighting towards information technology at close to 36%, this is likely a strong contender for investor portfolios.

WisdomTree Cloud Computing ETF - WCLD

On September 6, 2019, WisdomTree launched the Cloud Computing Fund to provide investors exposure to rapidly growing cloud companies. The ETF seeks to replicate the performance of BVP Nasdaq Emerging Cloud Index (EMCLOUD). The BVP Nasdaq Emerging Cloud Index “…is designed to track the performance of emerging public companies primarily involved in providing cloud software to their customers.” Cloud computing has taken off in in the last decade as companies both upgrade their IT infrastructure and to support work from anywhere. As of today’s writing, EMCLOUD has returned 874.1% since its inception in 2013 compared to the performance of the NASDAQ at 313.4%

Jeremy Schwartz, Global Head of Research at WisdomTree, had this to say about the fund when it was launched:

WCLD targets cloud computing businesses, which we believe are best positioned for high levels of recurring revenue growth and have the potential to scale at a faster rate than traditional tech companies. Cloud-based businesses typically have better profit margins and higher growth than other tech companies.

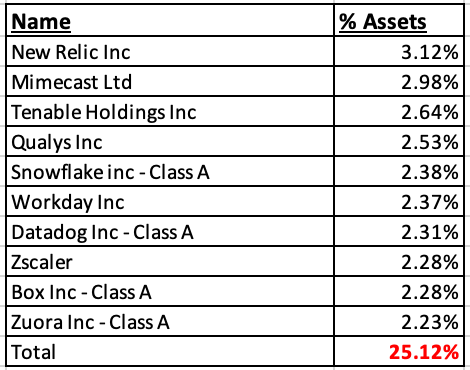

Similarly to the Next Gen 100 ETF, the top 10 holdings are not nearly as concentrated as the Nasdaq-100 Index:

WCLD does indeed have a good selection of cloud stocks. Datadog and New Relic are both strong companies in the observality space. Snowflake compiles data from multiple data lakes and places it into a data warehouse where businesses can more easily analyze and make use of the data. The company recently posted 110% YoY growth in product revenue and demonstrated an net revenue retention ratio of 173%. Zscaler is one of the leaders in Zero Trust and Secure Access Server Edge (SASE) with cybersecurity. Workday provides enterprise management solutions for HR and financial planning. An investor seeking exposure to disruptive tech and cloud stocks would benefit by investing in this ETF.

Global X Cloud Computer ETF - CLOU

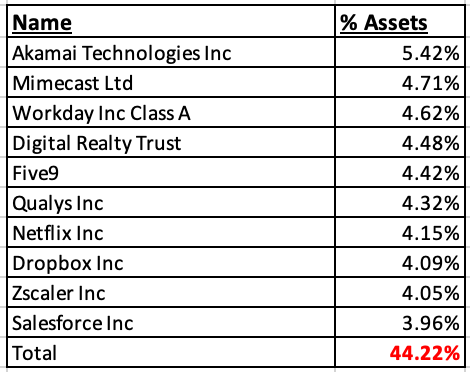

The Global X Cloud Computing ETF (CLOU), sponsored by Global X and launched in April 2019, seeks to replicate the performance of the INDXX Global Cloud Computing Index. The index is designed to track the performance of companies in Indxx’s Cloud Computing Industry. The top holdings are more concentrated than QQQJ and WCLD, but not quite as top heavy as QQQ:

Akamai provides content delivery networking (CDN) services for media, software delivery and cloud security. It is profitable and has good operating and cash flow margins. Mimecast provides cloud security for email to protect against delivery of malware. Netflix and Salesforce likely needs no introduction. Netflix has $28.6bn in TTM revenues and is a leader in video streaming. Salesforce is a stalwart in the SaaS industry and the first one built from scratch to achieve record growth. The company has outperformed the S&P 500 and the Nasdaq over the last 5 years and during this time provided investors with a ~199% return.

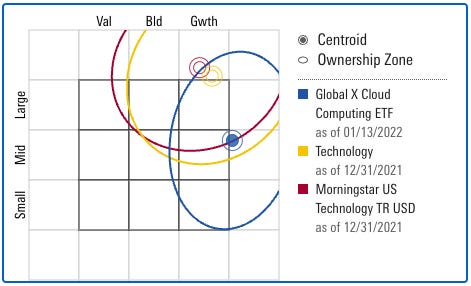

Due to the CLOU ETF containing these $100 billion + market caps, Morningstar ranks the overall market cap weighting as bordering between mid and large cap:

ARK Next Generation Internet ETF - ARKW

The suite of ARK Invest ETFs is a great place to look for thematic ETFs and covers a range of disruptive industries such as artificial intelligence, robotics and automation and DNA sequencing. Cathie Wood founded Ark Invest in 2014 and previously won many acolades including best stock picker of the year in 2020 by Bloomberg.

Many of these ETFs have performed quite poorly recently. Some question whether Cathie Wood has lost her winning touch such as this article from Business Insider and this one from one from a contributor on Seeking Alpha. It seems that some may not be aware that two of the ARK Invest ETFs, ARK Innovation ETF (NASDAQ: ARKK) and ARK Next Generation Internet ETF (NASDAQ: ARKW), have both outperformed QQQ over the last five years:

The ARK Next Generation Internet ETF targets six industries:

Cloud Computing & Cyber Security

E-Commerce

Big Data & Artificial Intelligence (AI)

Mobile Technology and Internet of Things

Social Platforms

Blockchain & P2P

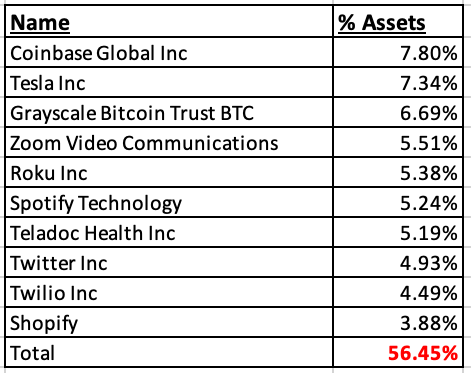

Below are the top 10 holdings for ARKW:

With a 7.80% weighting in Coinbase and 6.69% weighting in Grayscale Bitcoin Trust, the ETF currently has an over 14% weighting to crypto. Coinbase is down substantially from all time high and sometimes moves in tandem with the price of bitcoin, but the company continues to make interesting moves. This includes the acquisition of FairX, a CFTC-regulated derivatives exchange and just today announced a partnership with Mastercard to issue NFTs. Tesla accounts for 7.34% of the total assets in this ETF. Tesla has been a rockstar performer and Cathie Wood’s conviction to go against Wall Street's overall bearish sentiment has helped fund performance. Teladoc is a leader in telehealth and Shopify is a leading e-commerce platform that is used by 29% of websites in the U.S. that use e-commerce technologies.

Simliar to the Global X Cloud Computing ETF (CLOU), the market cap weighting borders between mid-cap and large-cap with a slight skew towards large-cap:

Conclusion

The Invesco ETF, QQQ, remains a great investment vehicle for investors. Top holdings include Apple, Microsoft, Amazon, Tesla etc. have rewarded investors handsomely over the years. These companies exemplify American innovation at it's finest and like Buffett said in his 2015 annual letter to shareholders:

For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs.

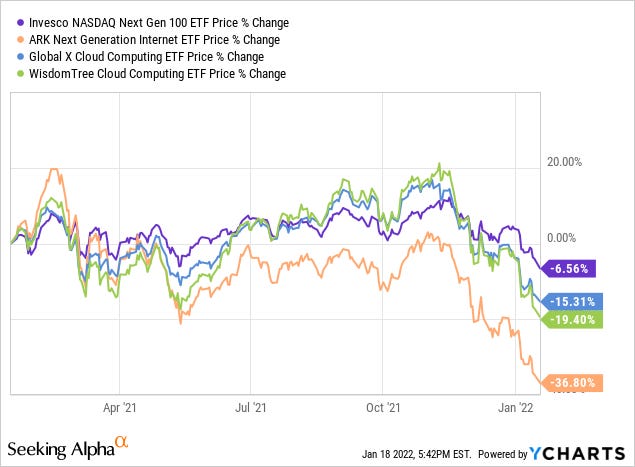

For investors with an appropriate investment time horizon, significant gains can potentially be achieved by investing in the next generation of innovators. With the exception of ARKW, which launched in September 2014, many of these newer ETFs do not have a long track record. The Invesco NASDAQ Next Gen 100 ETF (QQQJ) was launched 2020, while both the WisdomTree Cloud Computing Fund (WCLD) and the Global X Cloud Computing ETF (CLOU) launched in 2019. For this reason, it is difficult to compare historical returns. Comparing the performance since all four ETFs have traded, QQQJ has performed the best during this short time frame:

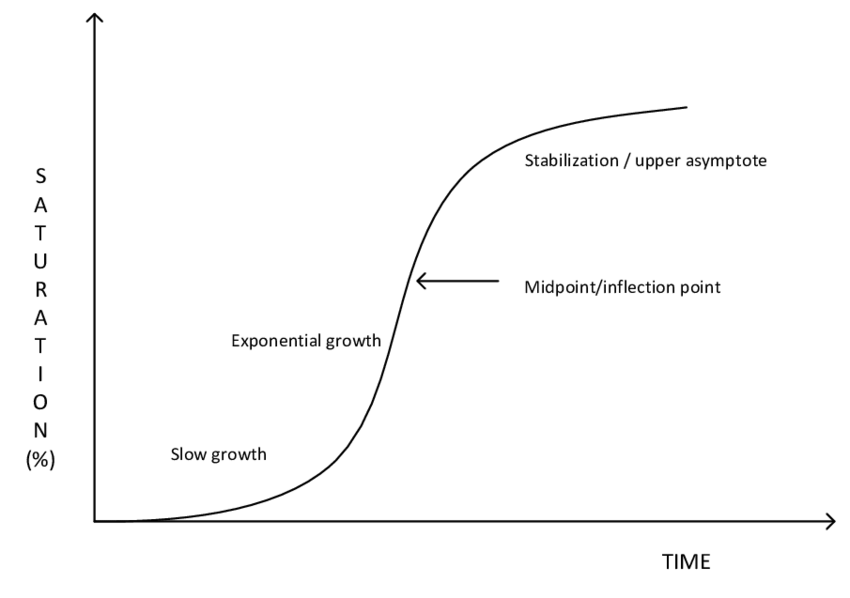

Zooming out, the ARKW ETF has achieved a return of 395.3% since inception from 2014. With results like that, a compelling case could be made to avoid these new ETFs and simply invest in ARKW. However, as noted above, the market weighting of ARWK is slightly skewed to large-caps, meaning that some of these companies may have already passed their fast-growth stage and are higher along on the S Curve with stabilizing growth:

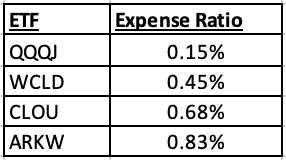

ARKW has the highest expense ratio of all the funds compared in this article but given the strong historical returns, the expense ratio appears justified when taking this into account. Below is the expense ratio for each ETF:

After examining the top 10 holdings of the above ETFs, QQQJ and WCLD appear to be more suitable ETFs for three reasons:

Stock style selection falls more squarely fall into the mid cap range. The purpose of this exercise is to find companies earlier in their growth stage and not large companies otherwise one can invest in QQQ

WCLD and ARKW have higher concentrations in the top 10 holdings. Larger concentration in top 10 holdings provide less diversification and, all else equal, is riskier.

The expense ratios are lower for QQQJ and WCLD