Braze Q3 2022 Earnings Recap

Braze reported a solid quarter...investors may start to take notice

Quick Note

If you would like to read my initial deep dive on Braze please click here.

Braze reported FY Q3 2022 earnings on December 20th. Note that Braze’s fiscal year and calendar year do not coincide. Braze’s FY 2022 ends January 31, 2022. The reported results are for the calendar quarter ending October 31, 2021.

Wall Street is Happy with Braze’s Earnings:

Braze’s stock price rocketed after hours when the company reported earnings. Below is a snap shot of some of the key metrics investors should look at:

Braze Q3 2022 Earnings Overview

Strong revenue growth reaching $64.0 million

63% increase YoY

15% increase QoQ

93% of revenue is subscription based. No change compared to FY’22 Q2

Remaining Performance Obligations, or RPO, stood at $304 million, an increase of 13% QoQ

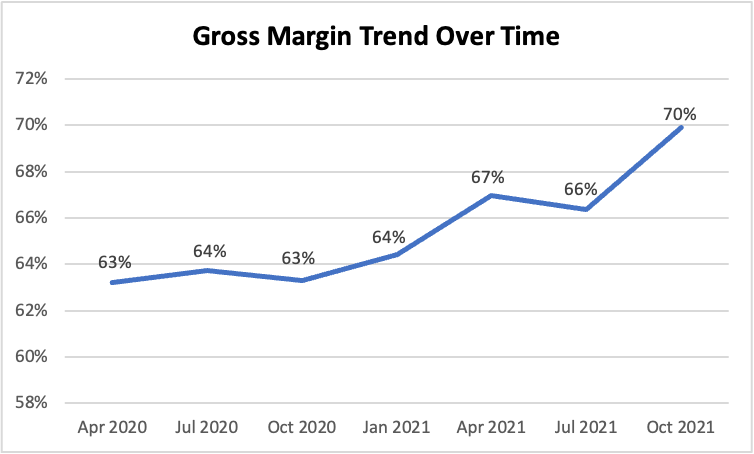

Increase in GAAP gross margins hitting 70%

Up 670 basis points YoY

Highest gross margin attained previously was 67% in FY’22 Q1

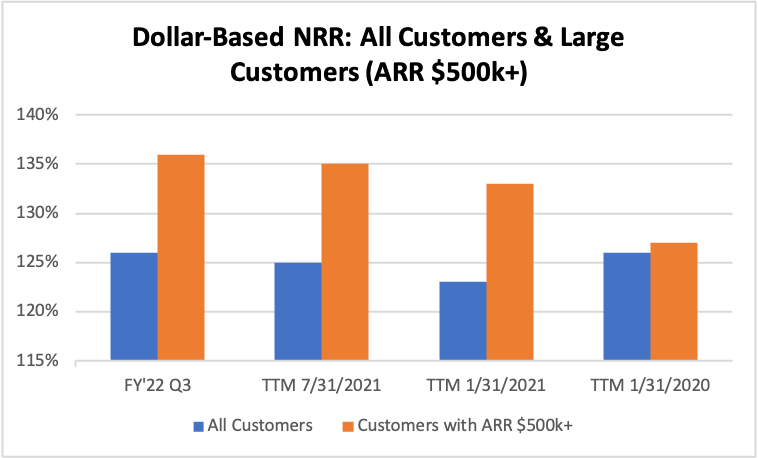

Existing customer base continues to increase spend. DBNRR was 126% for all customers and 136% for large customers (ARR >$500k)

Slight uptick compared to Q3 2021 for both customer cohorts

Total customers increased to 1,247

Increase of 48% YoY

Customers with ARR > $500k increased to 97

Increase of 45% YoY

GAAP net loss per share down slightly at ($0.42)

Compares favorably to a net loss per share of ($0.47) per share in FY’21 Q3

Non-GAAP net loss per share down considerably at ($0.16)

Compares favorably to a non-GAAP net loss per share of ($0.35) per share in FY’21 Q3

FCF up but still negative at ($3.5) million

Compares favorably to FCF of ($6.8) million in FY’21 Q3

Digging Into the Numbers

Arguably the most eye-opening things for investors to note was the strong revenue growth and increase in gross margins. Revenue grew 63% in the quarter. This not only represents company’s highest quarterly revenue since FY’21 Q1, but it’s the 3rd consecutive quarter of accelerating revenue growth:

GAAP gross margins reached 70% in the quarter. As discussed in my initital deep dive on Braze, I was looking for Braze to eventually hit gross margins in the 70s. This is discussed in a bit more detail in the conference call highlights below. Do not expect gross margins to go higher:

Dollar-based net retention ratio, or DBNRR, also continues to impress - particularly for customers with ARR > $500k. DBNRR hit a record high of 136% for large customers in the quarter. Higher DBNRR for large customers signifies that Braze has likely found a good product-market fit:

Customer count is up 71% since January 31, 2020. Customer growth, similar to revenue growth, has accelerated for the 3rd consecutive quarter.

Customer growth in the large cohort is an important part of this story. Braze notes that of the 1,247 total customers, 97 were large customers with $500k+ ARR. This represents an increase of 30 large customers YoY and sequential increase of 15 large customers:

The company continues to be unprofitable but is showing some areas of improvement in GAAP and non-GAAP numbers. GAAP net loss was ($8.8) million, representing a net profit margin of (14%). Net profit margin for the prior year’s quarter was (22%) on roughly the same of amount of net income. GAAP net loss per share was ($0.42). This is only a slight improvement compared to ($0.47) in the prior year’s quarter.

Non-GAAP net loss was $(3.3) million and non-GAAP net loss per share was $(0.16). This compares favorably to a non-GAAP net loss of ($6.5) million and ($0.35) in the prior year’s quarter. Sometimes Non-GAAP numbers excludes various items, but in this case Braze’s Non-GAAP number simply excludes stock-based comp. Non-GAAP net profit margin improved substantially from (17%) to (5%) in the quarter:

FCF was ($3.5) million and non-GAAP FCF margin was (5.4%) in the quarter. This is a marked improvement from FY’21 Q3, but over the last six quarters FCF and non-GAAP margin have fluctuated quite a bit with no real discernerable trend. CFO Winkles notes that this number will vary “materially” quarter-to-quarter given both the timing of payments from customers and payments to vendors. Naturally investors will want to see both FCF and FCF margins consistently positive over time:

Conference Call Highlights

Launched update to Canvas, the company’s drag-and-drop visual customer journey management environment. Customers are already seeing benefits including an on-demand streaming service that saw a 61% conversion rate by sending custom paths

Added 4 new partners to the company’s continuous customer engagement data streaming product

During the cyber holidays the company executed over 21 billion messages, including 3.7 billion e-mails, 370 million in-app and in-browser messages, and nearly 12 billion push notifications across iOS, Android and web

Headcount is up more than 300 in the fiscal year and now over 1,000 people. Continuing to expand globally and expecting to enter Toronto and Paris in 2022

Gross margins of 70% was a surprise. Management attributes this due to better aligned management structure and achieving economies of scale in tech expenses. There was also a seasonality component with respect to cost of revenue and will likely be lower in FY’22 Q4

Longer term Braze expects gross margins to be in the 65% to 70% range. This is due to gains in efficiences being offset by increase in computational and storage capacity requirements. The company received a few questions about gross margins and the CFO made it clear that the 65%-70% range is the long term goal

Braze’s emphasis and respect for first-party data is helping the company navigate Apple’s IDFA change (for readers unfamiliar about IDFA you can read this article. CEO says Braze is “…on the right side of history with respect to first-party data…”

Conclusion

Braze reported a really solid quarter. There were a number of things to like:

3rd consecutive quarter of accelerating revenue growth

3rd consecutive quarter of accelerating customer growth

Highest gross margins on record even though management clearly stated that this is already on the high end of long term range

Continued high DBNRR for all customers and even higher DBNRR for large customers

Improving profitability in both GAAP and non-GAAP numbers. GAAP net margins up from (22%) to (14%) and non-GAAP net margins improved from (17%) to (5%)

Q4 Guidance was arguably pretty weak. The company guided for estimated revenue in the range of $65-$66 million. Since the company achieved $64 million in revenue in Q3, this implies that the company is guiding for flat growth:

This does not make too much sense unless management is purposely sandbagging guidance or being ultra conservative. CEO Magnuson notes in the conference call that Q3 is typically weaker with Braze’s clients experiencing lower levels of activity. Braze should do well in Q4 as since it encompasses the holiday quarter. The CEO notes that the company hit “record-high daily volumes” in terms of messages sent during Black Friday and Cyber Monday holiday. The seasonality in Q4 should in theory allow Braze to issue higher guidance. Management likely wants to be conservative particularly as a newly publicly traded company.

The CEO’s statement about IDFA “…on the right side of history with respect to first-party data…” was interesting to hear. Magnuson called out Snapchat as an example of a company that publicly stated how they were hurt by Apple IDFA. He further states that the company wants to “…focus in on being a good listener as opposed to kind of being a creepy detective.” Not being creepy is a reference to the company’s commitment to forge more human and personal connections between consumers and brands. One of Braze’s company values is “Be a Human”. Hopefully continued growth in revenue and customers will prove that brands value this approach.

Braze’s market cap is currently around $7 billion. With TTM revenues of $210 million, this puts the TTM P/S ratio at ~33x. The company grew revenue 56% YoY in FY 2021 and is guiding for ~55% revenue growth YoY in FY 2022. The company appears to be executing well enough that they can likely achieve a similar percentage increase in revenue growth in FY 2023. This means that the company trades for around 20x FY 2023 revenues. From a business standpoint the company appears to be executing well and the CEO is certainly confident on the conference call. However, considering that the company is not profitable with FY 2022 guidance implying (14%) non-GAAP profit margin, at today’s valuation there does does not appear to be much near-term upside.